How to Secret Price Action ?

Hello traders, you have seen

many pro traders succeed from analyzing "naked" charts without any

tools on the charts. That is, they trade according to price action

Successful traders in trading

with price action must have a clear understanding of the 4 stages of the market

so that they can enter the most optimal orders. Those are:

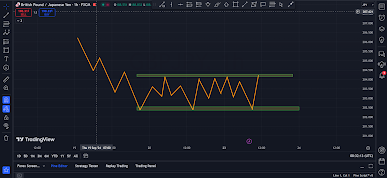

Accumulation phase

The accumulation phase occurs

when prices move in a narrow range, usually after a long downtrend. During this

phase, investors begin to accumulate positions, and the market experiences a

struggle between buyers and sellers.

About its characteristics, it

is easy to recognize on the chart, we often see

Prices do not have many large

fluctuations; instead, they fluctuate within a certain price range.

Trading volume is often low,

indicating uncertainty in the market.

Can form patterns such as

rectangles or triangles.

About Breakout

Upward Breakout On the

contrary, if the price breaks above the resistance level, it can be a signal

that the buyers are dominating. At that time, the market can move into the

progression phase.

Progression phase

We see that this is the phase

where the market begins to make a clear move in the direction of the price

increase, after going through the accumulation phase.

Characteristics of this phase

Prices usually move in an

upward direction with increased trading volume, indicating strong participation

of buyers.

New support levels will be

formed during the price increase.

There may be price patterns

such as a clear uptrend, followed by higher highs and lows.

Next is the Distribution Phase

The distribution phase occurs

after a strong uptrend, when prices move in a narrow range. This is when

sellers start to increase their pressure while buyers may have reached their

maximum buying level.

The characteristics of this

phase are usually

Prices fluctuate in a narrow

range, often forming patterns such as rectangles or triangles.

Trading volume may increase as

investors sell, but not enough to push prices higher.

After the distribution phase is

consolidated,

A Breakout will occur, there

are 2 breakout cases

Upward breakout: If prices

break above the resistance level of the distribution phase, the uptrend may

continue. This shows that there is still strong buying pressure in the market.

Downward breakout: If prices

break below the support level, it may be a sign that the uptrend has weakened,

and the market may move into a bearish phase.

When the market has moved a

long distance, it will start to fall into the

....................

0 Comments